Car insurance that rewards good driving.

Auto Quote

HiRoad is a behavior and usage-based auto insurance company. Customers get a maximum and minimum premium that fluctuates monthly based on how much and how well they drive allowing them to earn discounts and rewards each month. Driving behavior is tracked by an app on the customer’s phone.

Role and project goals

At HiRoad I was the lead product designer for our primary acquisition channel, the auto insurance Quote. Working closely with our executive leaders to determine business goals which we translated into UX strategy, wireframes, research test plans, user flows, prototypes, and design system components, the results of which were integrated into the product. As the product grew our brand and messaging evolved, and we worked closely with our brand team to ensure cohesion across all touchpoints.

In my role, I worked closely with our PM partners to identify opportunities to align with the growth of the product along with customer wants and needs. All while balancing insurance requirements which vary state by state and dictate limitations in content and user experience solutions.

Contribution highlights:

Enhanced “About you” section which led to an uptick in conversion

Worked with the developer team to create and implement the company’s first design system components across Quote

End-to-end UI refresh

Added educational content within Quote about how the product works post-purchase

Integrated social sign-in for creating a user account

Integrated Apple and Google Pay at purchase stage

Created content and design to clarify the pricing structure

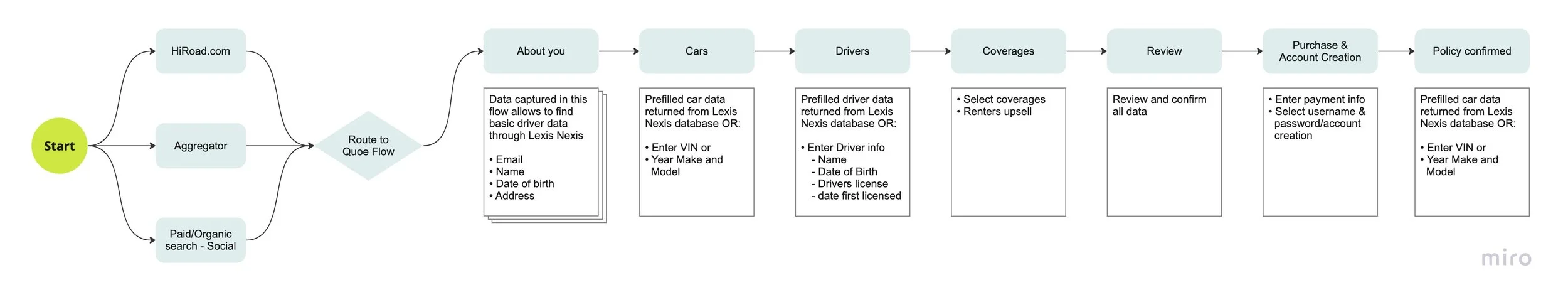

High Level Auto Quote Flow

Select Auto Quote Screens

LEARNINGS

With a goal of continual acquisition improvement in an already healthy conversion funnel, we were thorough in our approach to enhance the experience by conducting research, customer interviews, and working closely with data science partners to evaluate how new features and content would impact the numbers. We began using Optimizely which helped us hone in on solutions and gather data for enhancements.

One of our challenges was satisfying our insurance partners’ requirements while keeping the customer needs at the forefront, a delicate balance.